-

UNION INTERIM BUDGET 2024-25 -

-

Are cryptocurrencies the future of the digital world economy -

-

Breaking Waves, Breaking News: Lakshadweep’s Recent Developments Explored -

-

The Impact of the Digital Economy on Business and Society -

-

Augmented Marketing: A Comprehensive Guide -

-

How To Strengthen Your Email Marketing Using AI -

-

How Artificial Intelligence and Digitization Are Transforming Our Lives -

-

What Data Science Tools do the Experts Recommend? -

-

Robotic Process Automation Will Transform Your Business? Check Here! -

-

Edge Computing: How it is Reshaping Cloud Infrastructure -

Ascendas India Trust deepens presence in Hyderabad

New Delhi: Ascendas property Fund Trustee Pte. Ltd., the Trustee-Manager of Ascendas India Trust (“a-iTrust”), will be acquiring two buildings, aVance 5 & 6 in aVance Business Hub, HITEC City, Hyderabad. The combined leasable area to be acquired is 1.8 million square feet. a-iTrust has entered into purchase agreement with Phoenix Infocity Pvt. Ltd. for the same. Apart from this, a-itrust has also done a separate agreement with Phoenix Infocity Pvt. Ltd. to acquire five additional buildings in aVance Business Hub 2, a Special Economic Zone adjacent to aVance Business Hub.

There are 10 buildings with total leasable area of 4.6 million square feet in aVance Business Hub. Out of these 10 buildings, nine have been already completed and leased out to top IT companies like HCL, Cognizant, IBM and Amazon. The total area leased out is 3.4 million square feet.

To date, a-iTrust has acquired four buildings aggregating 1.5 million square feet. The Trust also has a right of first refusal to acquire four other buildings totaling 1.2 million square feet. a-iTrust has now entered into a forward purchase agreement to acquire the remaining two buildings (aVance 5 & 6) in aVance Business Hub. aVance 5 (1.16 million square feet) is under construction and expected to be completed by the second half of 2019. aVance 6 (0.64 million square feet) is completed and 98% leased to Amazon. The acquisition will take place of both the buildings after aVance 5 gets completed. The leasing levels are also to be met before acquisition.

Phoenix Infocity Pvt. Ltd. has decided to go with the plan to develop aVance Business Hub 2 in addition to aVance Business Hub. The 14.4 acres of aVance Business Hub 2 will comprise of seven buildings which will be developed over the period of five to nine years.

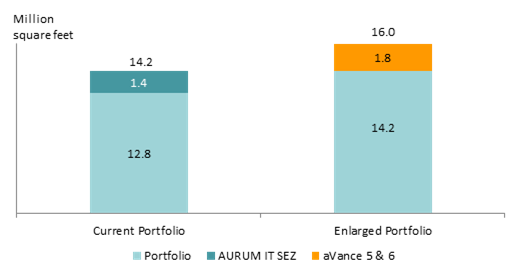

Sanjeev Dasgupta, Chief Executive Officer of the Trustee-Manager said, “The proposed acquisition of aVance 5 & 6 will allow us to deepen our presence in Hyderabad, which is currently witnessing robust rental growth arising from healthy demand from global IT companies. The Trust portfolio will increase to 16 million square feet once we complete the acquisition of AURUM IT SEZ and aVance 5 & 6. The opportunity to acquire an additional five buildings in future will allow the Trust to enjoy even greater economies of scale in Hyderabad, and further strengthen its competitiveness in the market.”

Details of the transaction

aVance 5 & 6

The transaction comprises a two-stage process.

Pursuant to the agreement, a-iTrust along with its affiliates will provide construction funding via inter-corporate deposits and debentures issued by the master developer amounting to INR 8,874 million/SGD 177.3 million. The schedule of debenture subscription is also secured with the property construction funding requirements.

a-iTrust will complete the acquisition by buying 100% of the shares in the master developer once the property achieves 90% leasing. The total purchase consideration, inclusive of the construction funding, is not expected to exceed INR 13,500 million/SGD 270 million1.

In the event that the actual completion date is delayed beyond March 2020 or if other events as defined in the share purchase agreement occur, a-iTrust will have the right to call for redemption of the debentures.

Effect on portfolio

The current portfolio of a-iTrust will increase from 14.2 million square feet to 16 million square feet. This stands to a significant 13 per cent growth.